SOL Price Prediction: Technical Bearishness Meets Long-Term Fundamental Strength

#SOL

- Technical Positioning: SOL trades below key moving averages with negative momentum indicators suggesting near-term caution

- Ecosystem Development: Major upgrades and institutional adoption projects provide strong fundamental underpinnings for long-term growth

- Market Sentiment: Contrast between immediate price pressure and optimistic long-term projections creates strategic entry opportunities

SOL Price Prediction

SOL Technical Analysis: Bearish Signals Dominate Short-Term Outlook

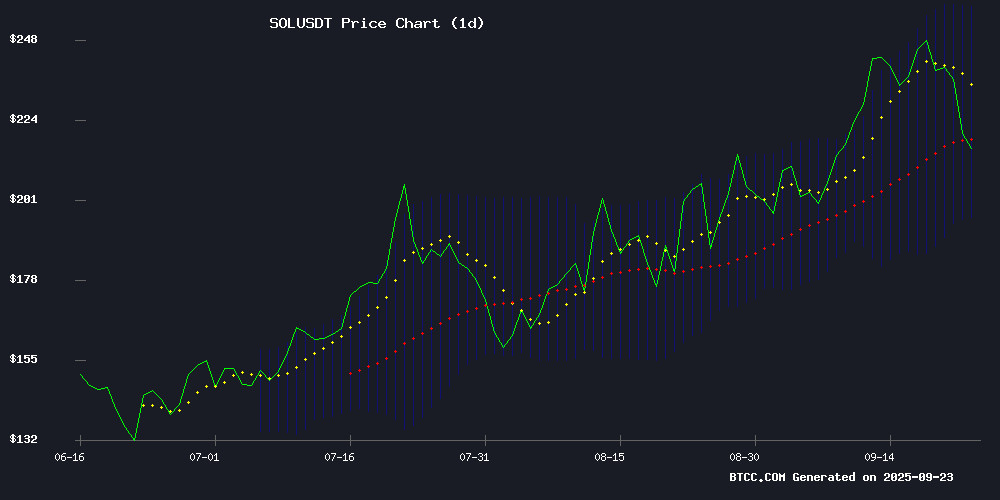

SOL is currently trading at $217.88, below its 20-day moving average of $226.83, indicating near-term bearish pressure. The MACD reading of -16.26 remains negative, though the histogram shows slight improvement at 0.46, suggesting potential momentum stabilization. Bollinger Bands position the price NEAR the middle band with upper resistance at $257.19 and lower support at $196.47.

According to BTCC financial analyst Emma, "The technical picture shows SOL struggling to regain bullish momentum. Trading below the 20-day MA with negative MACD signals near-term caution. However, the Bollinger Band positioning suggests consolidation rather than sharp decline."

Mixed Fundamentals Create SOL Uncertainty Despite Long-Term Optimism

Solana's ecosystem shows contrasting signals with the promising Alpenglow upgrade aiming for Google Search-level speeds and Kazakhstan's Tenge-pegged stablecoin launch, while facing immediate headwinds from September's price decline and Helius Medical's substantial purchases failing to prevent a 6% slide.

BTCC financial analyst Emma notes, "The fundamental landscape presents a tale of two timeframes. Near-term whale movements and failed price support from large purchases create uncertainty, but long-term developments like VanEck's $3,211 target and institutional adoption through tokenization projects provide bullish catalysts."

Factors Influencing SOL's Price

Solana's Alpenglow Upgrade Aims to Outpace Google Search Speeds

Solana's upcoming Alpenglow upgrade targets transaction finality of 100-150 milliseconds—surpassing the average response time of a Google search. This technical leap could redefine latency expectations in decentralized finance, positioning SOL as a leader in blockchain performance metrics.

The network's focus on sub-second finality addresses a critical bottleneck in DeFi adoption. By achieving speeds comparable to traditional web services, solana narrows the usability gap between centralized and decentralized systems.

Kazakhstan Launches Solana-Based Evo Stablecoin Pegged to Tenge

Kazakhstan has introduced the Evo stablecoin, a Solana-based digital currency pegged to the national tenge. The initiative seeks to merge cryptocurrency markets with traditional financial systems, leveraging Mastercard's infrastructure for broader accessibility.

The MOVE signals growing institutional interest in blockchain solutions for fiat currency stabilization. Solana's high-speed blockchain was selected for its scalability advantages in payment applications.

VanEck's Bullish $3,211 Solana Price Target by 2030: Realistic or Speculative?

Asset manager VanEck's late-2023 valuation framework paints a striking bull case for Solana (SOL), projecting a $3,211 price target by 2030. At current levels near $220, this implies a 14.5x surge—propelling SOL's market cap to $1.7 trillion. The forecast aligns with institutional momentum, as financial infrastructure develops to support such growth.

VanEck's near-term base case of $520 by 2025 underscores its confidence in Solana's scalability advantages. While ambitious, the target reflects growing recognition of SOL's position as a high-throughput blockchain contender. Market participants note that achieving this valuation WOULD require sustained adoption across decentralized finance and institutional use cases.

Solana Loses September Gains: Will October 2025 Be Different?

Solana (SOL) has retreated below $220, erasing mid-September gains that briefly pushed it to $251. The asset now shows mixed performance—down 0.3% daily and 6.9% weekly, but retains a 51.4% surge since September 2024. Market-wide volatility, fueled by Federal Reserve policy uncertainty, has dragged down SOL alongside other cryptocurrencies.

Historically bearish September trends have repeated in 2025, yet October’s bullish reputation offers hope. A Q4 rebound aligns with seasonal patterns and potential Fed easing. Solana’s fate hinges on broader market momentum as institutional eyes watch for crypto’s next inflection point.

Helius Medical Initiates $500M Solana Treasury Strategy with Initial $164M Purchase

Helius Medical Technologies has launched its digital asset treasury (DAT) program with a 760,000 SOL acquisition worth approximately $164 million at current prices. The biomedical firm retains $335 million in dry powder for future crypto acquisitions, targeting a total $500 million position over 12-24 months.

The Solana-focused strategy follows an oversubscribed $500 million private placement led by Pantera Capital. "This accumulation plan demonstrates capital efficiency," said Pantera's Cosmo Jiang, noting purchases were executed below market rates. HSDT shares initially surged 200% on the DAT announcement before retreating 14% post-purchase disclosure.

Helius plans to explore staking and DeFi opportunities within a conservative risk framework. Executive chairman Joseph Chee emphasized the company's regained strategic flexibility, with most allocated capital remaining un deployed for future crypto market opportunities.

Helius Medical's $167M SOL Purchase Fails to Halt Solana's 6% Slide

Solana's native token SOL tumbled more than 6% on Monday, defying expectations after Helius Medical Technologies revealed a $167 million treasury purchase. The neurotech company acquired 760,190 SOL at an average price of $231, marking its inaugural move into digital asset reserves.

The market's muted response comes despite Helius' substantial war chest - $335 million in cash reserves earmarked for further crypto acquisitions. "Support from Solana ecosystem stakeholders has been gratifying," remarked Joseph Chee, Helius' Executive Chairman, referencing partnerships with staking providers and DeFi protocols.

This strategic pivot follows last week's $1.25 billion capital raise, structured through a PIPE deal and sales offering led by Pantera Capital and Summer Capital. The divergence between institutional accumulation and spot price action highlights crypto markets' complex valuation dynamics during periods of macroeconomic uncertainty.

Solana Whales Move $836 Million Amid Market Uncertainty

Solana's market dynamics are at a crossroads as whales transfer over 2.5 million SOL—worth $836 million—primarily to Binance, signaling potential sell pressure. Meanwhile, a $54 million inflow to Coinbase Institutional suggests strategic repositioning rather than outright liquidation.

The $214-$220 support zone remains critical for SOL's price action. Repeated rejections NEAR $240 indicate buyer hesitation, but sustained support could fuel a rally toward $260. Conversely, a breakdown may trigger deeper corrections.

Network activity paints a mixed picture: Daily Active Addresses dropped 27%, yet persistently positive Funding Rates reveal lingering derivatives optimism. This divergence leaves SOL caught between weakening on-chain utility and speculative bullishness.

Forward Industries to Tokenize $1.65B Stock on Solana via Superstate

Forward Industries, the largest Solana-focused treasury company, plans to tokenize $1.65 billion of its stock on the Solana blockchain through Superstate's Opening Bell platform. This move positions the Nasdaq-listed firm among the first public companies to issue tokenized equity directly on-chain, reinforcing its strategy to build a Solana-anchored balance sheet.

Shareholders will convert common stock into tokenized FORD shares via Opening Bell, enabling 24/7 trading, instant settlement, and expanded global liquidity. Forward is also taking an equity stake in Superstate to align interests and collaborate on future product development.

Partnerships with Solana-based protocols like Drift, Kamino, and Jupiter Lend aim to integrate FORD tokens as collateral in lending systems, marking a significant step toward institutional DeFi adoption.

Is SOL a good investment?

SOL presents a complex investment case balancing short-term technical weakness against long-term fundamental strength. Current technical indicators show bearish momentum with price below key moving averages and negative MACD, suggesting caution for immediate entry.

| Metric | Current Value | Signal |

|---|---|---|

| Price vs 20-day MA | $217.88 vs $226.83 | Bearish |

| MACD | -16.26 | Bearish |

| Bollinger Position | Near Middle Band | Neutral |

| Key Support | $196.47 | Critical Level |

Fundamentally, the Alpenglow upgrade and institutional adoption through projects like Forward Industries' $1.65B tokenization provide strong long-term catalysts. However, recent whale movements and failed price support from large purchases indicate near-term uncertainty.

As BTCC financial analyst Emma summarizes, "Investors should consider dollar-cost averaging given the technical-pressure-versus-fundamental-promise dynamic. Risk-tolerant investors might find current levels attractive for long-term holdings, while conservative investors may wait for technical confirmation of reversal."